Brazil is making significant strides in the crypto sector with the launch of BRL1, a stablecoin pegged directly to the Brazilian real.

Spearheaded by leading platforms like Mercado Bitcoin, Foxbit, and Bitso, BRL1 brings a faster, more efficient way for Brazilians to move funds between crypto exchanges without relying on traditional banking systems.

An Attempt to Decrease Challenges for Crypto Users

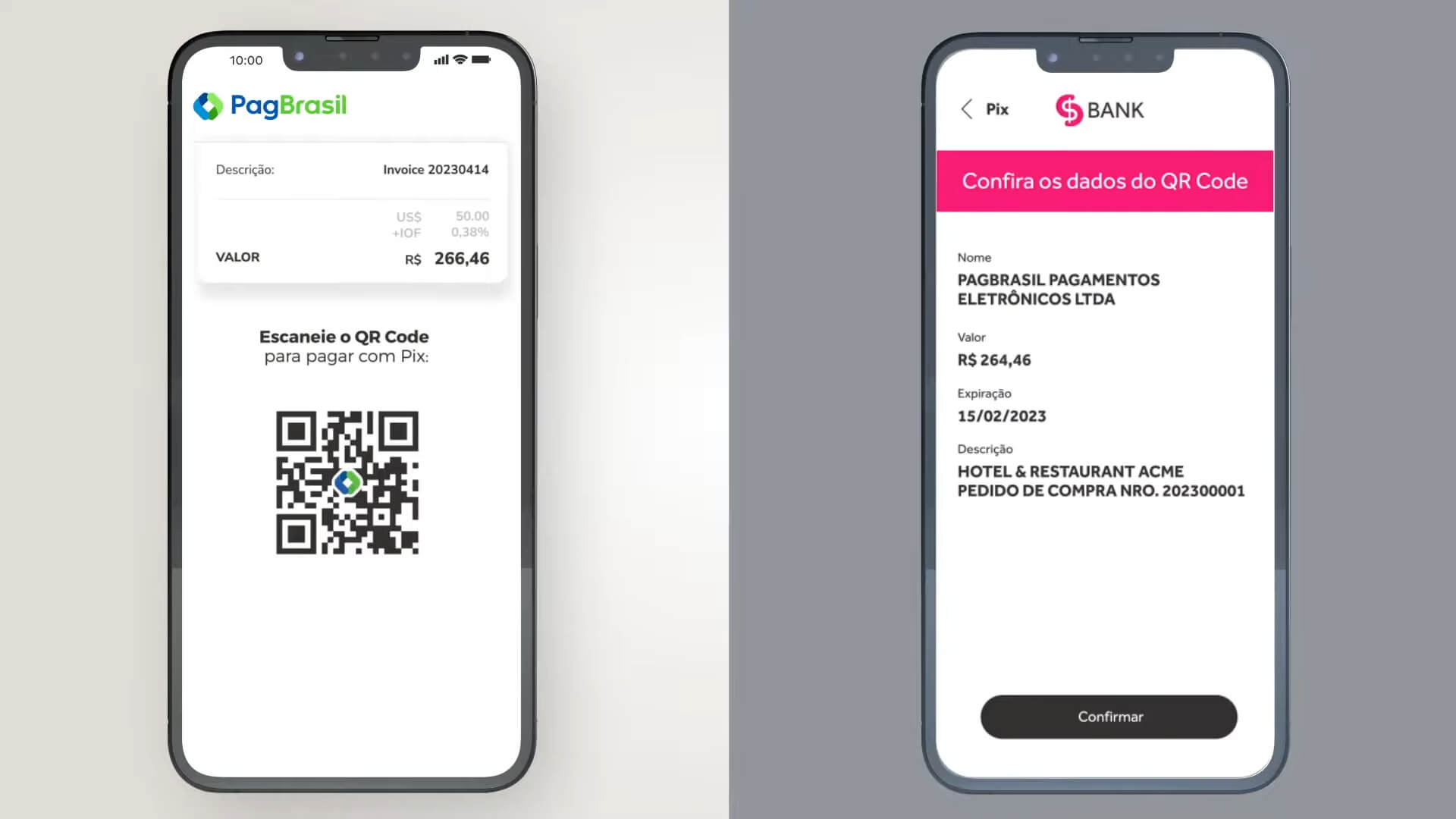

Brazilian users currently rely on Pix, the national instant payment system, to transfer funds between exchanges. This process often involves multiple steps and delays, discouraging many from fully utilizing cryptocurrency options.

BRL1 is tied one-to-one with the Brazilian real, offers a seamless, direct transfer method between exchanges. Users can now complete transactions across platforms without needing to leave the crypto ecosystem.

Fabrício Tota from Mercado Bitcoin notes that BRL1 will allow users to engage with cryptocurrencies without the need for extra steps, effectively bridging the gap between digital assets and Brazil’s traditional financial systems.

Backed by Treasury Bonds for Stability

To ensure value stability, BRL1 is backed by National Treasury bonds, with an initial issuance valued at R$10 million. This design not only anchors the coin to the Brazilian real but also provides an added layer of security through bond-backed reserves.

Audits will maintain transparency, giving users confidence in the stablecoin’s reliability.

For comparison, some of the best stablecoins globally, like USDC, USDT, and DAI, also use various models to ensure stability and trust, offering a useful benchmark for understanding BRL1’s approach.

There are future plans to share part of the income generated from these bonds with BRL1 holders, though the specifics on this revenue model remain under discussion.

Brazil also introduced a 17.5% tax on digital trading.

Expanding Possibilities with Drex Integration

In a move to further expand BRL1’s reach, the stablecoin will integrate with Brazil’s Drex platform, the Central Bank’s blockchain initiative. This development will widen BRL1’s applications beyond cryptocurrency trading, allowing it to be used for investment tokens, loans, and other digital assets within Brazil’s financial framework.

Potential for Cross-Border Transactions

Some foreign exchanges have shown interest in listing BRL1. Such a step could make the stablecoin a viable tool for international payments.

The expansion aligns with Brazil’s goal to establish itself as a leader in digital finance. It can help it with strengthening cross-border connections through blockchain technology.

BRL1 represents a targeted solution for Brazil’s crypto market, with clear benefits for both local users and potential international applications. Backed by secure assets and a straightforward vision, this stablecoin stands as a major step in Brazil’s financial evolution.

Read Next – Brazil Approves AI Regulation Bill