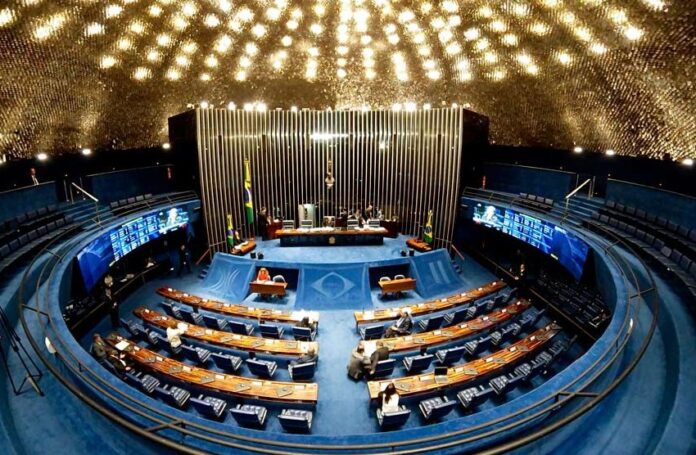

The tax reform in Brazil has sparked heated debates after the Senate Constitution and Justice Committee approved a proposal that excludes weapons and ammunition from the selective tax.

The decision has led to widespread criticism, exposing stark political and economic divisions.

Main Goals of the Tax Reform

The reform seeks to simplify Brazil’s tax system by merging various taxes into a unified value-added system.

This change will replace multiple taxes, including ICMS, ISS, PIS, Cofins, and IPI, with two new components.

One will cover goods and services, while the other will focus on contributions. The proposal also introduces a selective tax for goods and services that harm health or the environment.

Exclusion of Weapons from the Tax

One of the most debated aspects of the reform is the removal of weapons and ammunition from the selective tax. The decision was driven by opposition figures led by Senator Flavio Bolsonaro, who argued that weapons should not be taxed under the “sin tax” category.

In a separate vote, the Senate approved this exclusion by a margin of 16 to 10. Critics argue that this move prioritizes political interests over public safety.

Das duas emendas possíveis por partido na Reforma Tributária, o PL decidiu em sua bancada de Senadores, por unanimidade, que a exclusão do “imposto do pecado” sobre armas e munições era prioritária.

Temos compromisso com a liberdade, o respeito ao direito de legítima defesa e… pic.twitter.com/cBhoO016KU

— 🇧🇷 Jorge Seif Junior (@jorgeseifjunior) December 11, 2024

Zero Tax Rate on Essential Food Items

The reform maintains a zero tax rate for key products in the Brazilian diet, ensuring that basic nutrition remains affordable.

- Meat: Beef, pork, lamb, goat, and poultry products.

- Fish: Various species, with certain premium types like salmon and tuna excluded.

- Dairy: Cheeses such as mozzarella, Minas, Prato, coalho, ricotta, requeijão, provolone, parmesan, fresh non-matured cheese, and queijo do reino.

- Grain: Rice, beans, wheat flour, and manioc flour.

- Bread: Common bread varieties.

- Other Essentials: Table salt and pure sodium chloride.

Reduced Tax Rates for Processed Items

While the zero tax rate applies to unprocessed and minimally processed foods, certain processed items receive a reduced tax rate of 60% of the standard rate.

- Edible Oils: Soybean, corn, canola, and other vegetable oils.

- Beverages: Mineral water.

- Snacks: Biscuits and cookies.

Zero Tax Rate on Specific Medications

The reform extends tax exemptions to critical healthcare products.

- Medications: Treatments for cancer, diabetes mellitus, rare diseases, sexually transmitted infections, and neglected diseases.

- Preventive Health Products: Vaccines and serums.

- Government Program Inclusions: Products listed in the Farmácia Popular program.

Cashback Program for Low-Income Families

To further support low-income households, the reform introduces a cashback program for families registered under the Cadastro Único (CadÚnico) system. The program provides partial refunds on taxes paid for essential services, with the following specifics:

- Eligibility: Families with a per capita income up to half the minimum wage.

- Refund Mechanism: Direct credits on utility bills, detailing the tax amount and the corresponding refund.

Relator da reforma tributária inclui armas e munições entre produtos que deverão pagar mais impostos: já os serviços de telecomunicações e internet foram incluídos no cashback, mecanismo criado para a devolução do imposto pago às famílias de baixa renda. Entenda no vídeo: pic.twitter.com/P0dUuADDFv

— TV Senado (@tvsenado) December 10, 2024

Refund Rates

- Liquefied Petroleum Gas (LPG): 100% refund of the federal tax (CBS) and 20% of the state tax (IBS).

- Utilities: Electricity, water, sewage, and piped gas services receive a 100% refund of CBS and 20% of IBS.

- Other Goods and Services: A 20% refund of both CBS and IBS.

Why the Exclusion of Weapons Stands Out?

The decision to exclude weapons and ammunition from taxation has drawn criticism from various sectors.

Many see it as a concession to right-wing political groups, given the current focus on reducing violence and improving public safety.

Opponents of the decision believe it undermines the broader goals of the reform by favoring political agendas.

Larissa Rodrigues: A bancada da Segurança Pública, conhecida como “bancada da bala”, atuará para retirar o imposto extra sobre armas nas mudanças incluídas na reforma tributária. #BastidoresCNN pic.twitter.com/0vToRAfOBq

— CNN Brasil (@CNNBrasil) December 10, 2024

And if you think this is controversial, that’s noting compared to the popular TV show SBT is planning to revive, the Aqui Agora.

Next Steps in the Legislative Process

The proposal will now move to the Senate plenary for a final vote. If approved, it will return to the Chamber of Deputies for further evaluation.

Lawmakers aim to finalize the reform by December 20, before the legislative recess begins.

Read Next – New Tax Reform Proposal in Brazil Promises Relief for Middle Class.