Brazil has one of the largest populations in the world, but its internet access tells a different story. In cities, connectivity might be decent, but go into rural areas, and it is a struggle. Many places still lack fiber optic networks, leaving entire communities cut off from the digital world. This is where Spacesail sees an opportunity.

In October 2024, Brazilian officials, including Minister of Communications Juscelino Filho, visited Spacesail’s headquarters in Shanghai. They discussed plans to bring low Earth orbit (LEO) satellite internet to regions that have been overlooked for years.

The timing is no coincidence. With the G20 summit recently held in Rio de Janeiro, Brazil has been actively pushing initiatives that focus on reducing inequalities and boosting connectivity.

Who Is Spacesail, and What Are They Planning?

Spacesail operates under Shanghai Spacecom Satellite Technology (SSST). If you have never heard of them, that is probably because their projects have been mostly under the radar—until now.

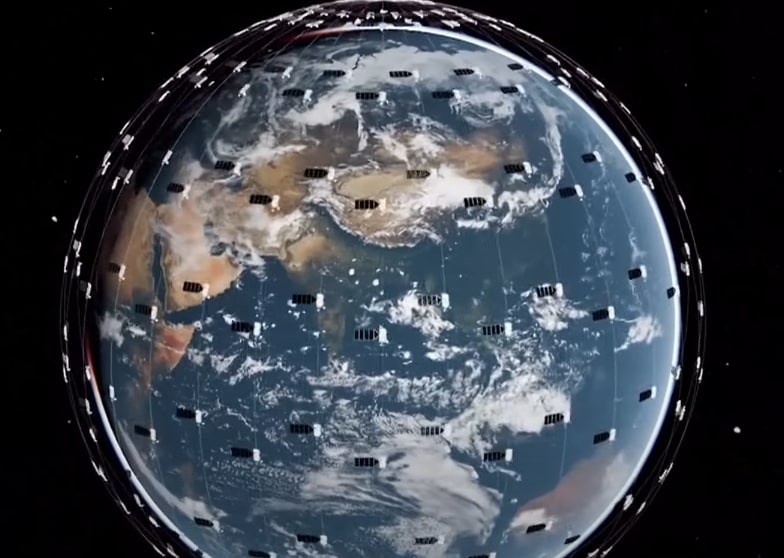

Spacesail is working on the “Qianfan Constellation,” a massive plan to deploy over 15,000 satellites by 2030. These satellites will orbit closer to Earth than traditional ones, allowing faster and more reliable internet connections.

The first 18 satellites for this constellation launched in August 2024, marking the start of an ambitious journey. While other players like Starlink have already entered the market, Spacesail is banking on its partnerships and focused rollout to carve out its place in the competition.

Plan to Compete with Starlink

Brazil’s rollout is set for 2026, and the company has already been talking with local authorities and Telebras, the state-owned telecom company, to get things moving.

What sets Spacesail apart, at least for now, is its focus on partnerships. Unlike Starlink, which operates mostly independently, Spacesail is aligning itself with Brazil’s government, a smart move in a country where politics and business are deeply intertwined.

Comparison of Spacesail and Starlink in Brazil

| Feature | Spacesail | Starlink |

|---|---|---|

| Launch Year in Brazil | 2026 | 2022 |

| Satellite Network Goal | 15,000+ satellites by 2030 | ~12,000 satellites by mid-2020s |

| Focus Areas | Rural and underserved regions | Global with some focus on remote areas |

| Local Partnerships | Strong collaborations with the Brazilian government and Telebras | Minimal local involvement |

| Public Perception | Positive due to government backing | Damaged by past controversies |

| Pricing Strategy | Competitive, tailored to local needs | Standard global rates |

| Relationship with Brazil | Actively working with regulators and officials | Strained due to broken promises and regulatory clashes |

Comparison on a Global Level

| Feature | Spacesail | Starlink |

|---|---|---|

| Launch Year | 2024 (First satellites) | 2019 (First satellites) |

| Satellite Network Goal | 15,000+ satellites by 2030 | ~12,000 satellites by mid-2020s |

| Primary Focus | Providing internet access to underserved regions globally | Offering high-speed internet worldwide, with a focus on remote areas |

| Current Global Availability | Limited; operations starting in select countries by 2026 | Active in over 50 countries |

| Partnership Approach | Collaborates with governments and local partners | Operates independently, with minimal local collaboration |

| Technology | Low Earth orbit satellites with advanced latency reduction | Low Earth orbit satellites offering consistent global coverage |

| Public Perception | Emerging player with government endorsements | Mixed due to controversies but recognized as a leader |

| Environmental Concerns | Potential issues with debris due to large-scale satellite deployment | Criticized for contributing to space debris and environmental risks |

Can Spacesail Take on Starlink?

The rivalry between Spacesail and Starlink feels like a real turning point for satellite internet. Starlink has been around for years and already dominates the market.

Spacesail is new but seems ready to challenge that dominance, especially in places like Brazil where trust in Starlink is shaky.

Starlink Has the Advantage

Starlink is a step ahead in almost every way right now. It has thousands of satellites in orbit, serves users in dozens of countries, and already provides fast, reliable internet to people who had no other options. Its global scale and experience are undeniable.

How Spacesail Might Win in the End

Spacesail is not trying to beat Starlink by doing the same thing. It is focused on local partnerships, working with governments like Brazil to serve areas that still lack basic connectivity. Pricing might also be a major factor.

If Spacesail can offer a cheaper, more accessible service, it could win over the people Starlink has yet to reach.

The Feud with Musk That Drove Brazil to Spacesail

Elon Musk’s relationship with Brazil has been far from smooth—it is been outright messy. His promises, actions, and business dealings in the country have created frustration, mistrust, and even resentment.

These issues might be the biggest reason Brazil is looking to Spacesail, a Chinese-backed company, as a potential alternative.

Did you know that Musk earns around $40 million per day?

Broken Promises to the Amazon

When Musk first visited Brazil in 2022, it was a spectacle. He pledged to bring Starlink internet to Amazonian schools and indigenous communities, painting a picture of progress and inclusion. But very little happened after that.

The promised connections either never materialized or were so limited that they made no real impact. For Brazil, a country already weary of foreign companies making grand promises and delivering little, this was a serious blow to Musk’s credibility.

Misinformation on X (Formerly Twitter)

Musk’s platform became a breeding ground for misinformation during Brazil’s volatile elections. Political chaos and conspiracies flourished on X, damaging the country’s social stability. Regulators took action, fining Musk’s company and temporarily banning the platform multiple times.

Brazil’s Supreme Court orders 𝕏 to be banned in the country until it “complies with court order”.

Says anyone using VPN to access 𝕏 is subject to fines up to $8,874 a day. pic.twitter.com/XTwIDHDwpf

— Tommy Robinson 🇬🇧 (@TRobinsonNewEra) August 30, 2024

This did not sit well with Brazilian officials, who felt Musk’s response lacked accountability. Instead of addressing the issue, Elon Musk dismissed it as a free speech debate, alienating local regulators even further.

Brazil 🇧🇷

X has been banned in Brazil.

“When we lose free speech, we lose democracy.”

~ Elon Musk

— James Melville 🚜 (@JamesMelville) August 31, 2024

For Brazil, this standoff showed a lack of respect for their governance and further strained relations between Musk and the government.

However, the ban got lifted in October.

🚨URGENTE – Ministro Alexandre de Moraes autoriza a reativação do X no Brasil

Alexandre de Moraes, acaba de liberar o uso do X no Brasil. A informação foi confirmada pelo jornalista da BandNews pic.twitter.com/e7rqCoe0qx

— SPACE LIBERDADE (@NewsLiberdade) October 8, 2024

Can Spacesail Challenge Starlink on a Global Level?

Spacesail is backed by the Chinese government, and that comes with baggage. Concerns about surveillance, data security, and geopolitical dominance could create roadblocks for Spacesail in many regions.

Given existing bans on Huawei and other Chinese tech firms, the likelihood of Spacesail gaining traction in Western markets is slim.

Governments are unlikely to let a Chinese-backed satellite network handle critical infrastructure like internet connectivity, especially when security risks are part of the conversation.

On the flip side, China’s strong relationships with developing nations, especially in Africa, South Asia, and South America, could help Spacesail gain ground.

Countries that benefit from China’s infrastructure projects, like those under the Belt and Road Initiative, might welcome Spacesail as part of their technological development.

We should also not forget the growing influence of BRICS. As the bloc strengthens its economic and political ties, members like Brazil, Russia, India, China, and South Africa may favor collaborations that reduce reliance on Western technology.

Read Next: Brazil Africa Forum